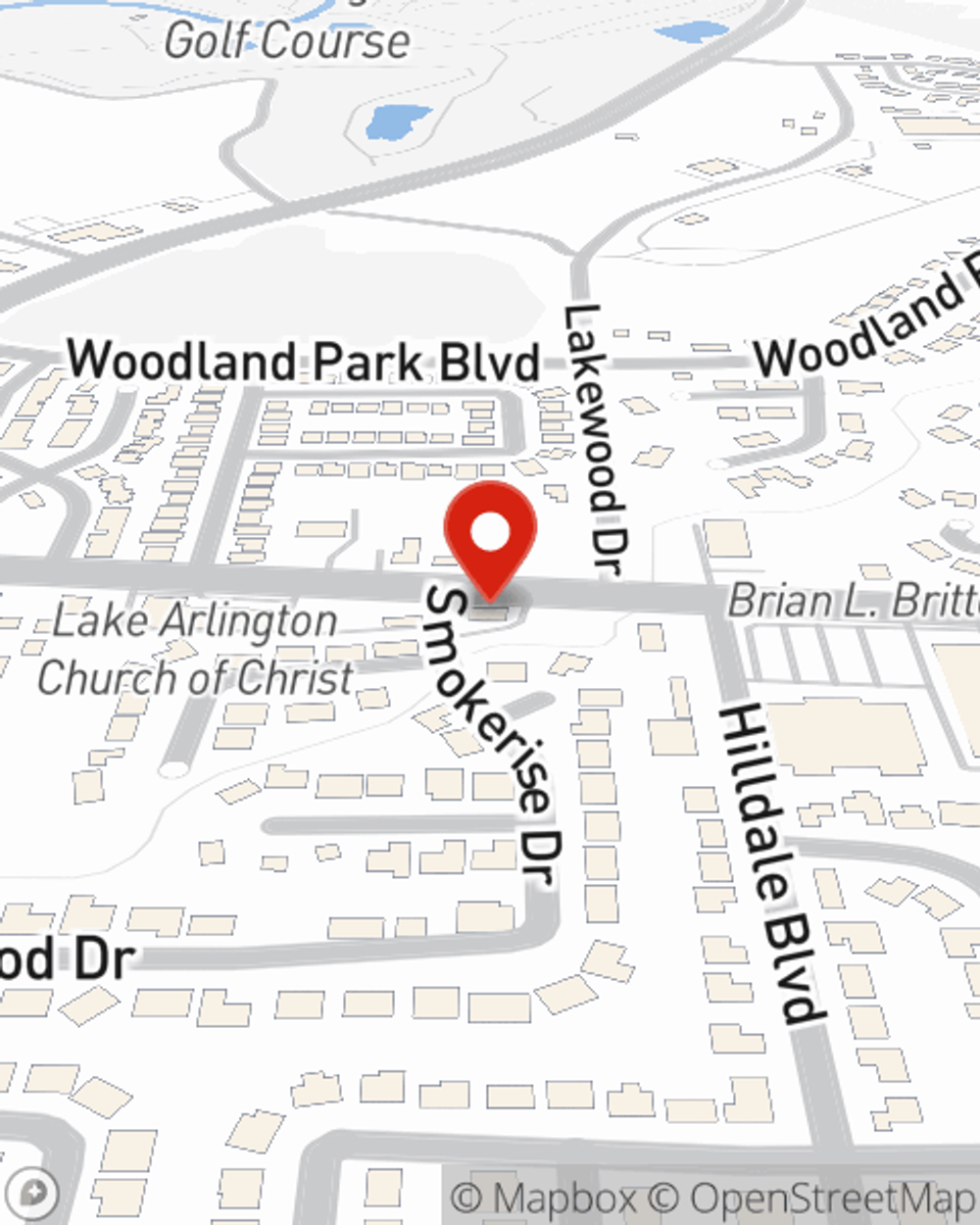

Homeowners Insurance in and around Arlington

Looking for homeowners insurance in Arlington?

Help cover your home

Would you like to create a personalized homeowners quote?

- Tarrant County

- Parker County

- Denton County

- Arlington

- Mansfield

- Dalworthington

- Pantego

- Kennedale

- Grand Prairie

- Hurst

- Euless

- Bedford

- Irving

- Rendon

- Burleson

- Westover Hills

- Ridglea

- Ryan Place

- Woodhaven

- Fort Worth

- Grapevine

- Colleyville

- Southlake

- Westlake

What's More Important Than A Secure Home?

After a long day, there’s nothing better than coming home. Home is where you slow down, relax and laugh and play. It’s where you build a life with your favorite people.

Looking for homeowners insurance in Arlington?

Help cover your home

Safeguard Your Greatest Asset

Mark Leal can walk you through the whole coverage process, step by step. You can have a hassle-free experience to get coverage options for everything that’s meaningful to you. We’re talking about more than just protection for your swing sets, appliances and home gadgets. Protect your family keepsakes—like pictures and collectibles. Protect your hobbies and interests—like musical instruments and sports equipment. And Agent Mark Leal can share more information about State Farm’s great savings and coverage options. There are savings if you have home security devices or choose a higher deductible, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

It's always the right move to protect your home and valuables with State Farm. Then, you won't have to worry about the unexpected fire damage to your property. Contact Mark Leal today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Mark at (682) 323-5033 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

What to do after an earthquake

What to do after an earthquake

Steps to stay safe after an earthquake and ways to help protect your property.

Simple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

What to do after an earthquake

What to do after an earthquake

Steps to stay safe after an earthquake and ways to help protect your property.